The self-appointed gods of Clown World are having trouble understanding the difference between power and influence, and that no amount of influence – which is what money always and ultimately amounts to – is an effective substitute for actual material power:

We come back to the question of why anybody believed $60 billion could move the needle for Kiev’s cause in the first place. But this question is, alas, difficult to answer because policymaking in Washington is enshrouded under a thick fog that consists of two dominant components: magical thinking and political imperatives. For those who earnestly believed that $60 billion would turn the tide of the war, it is more of the former; for those aligning themselves with the political winds and pretending to support Ukraine much as a mime pretends to be trapped in a phone booth, it is the latter. In many cases it is both, and it is difficult to tell where one begins and the other ends.

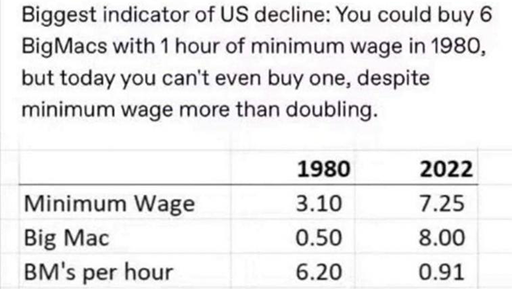

Magical thinking is a recognizable symptom of that particular moment in time when an erstwhile great power is in decline but events have not quite yet forced it to come to grips with that decline. It is also a time of diminished scope for action. In times past, perhaps Washington would have solved a crisis such as Ukraine through crafty diplomacy or orchestrated a formidable proxy war with its industrial might and military expertise. But the US now seems incapable of sophisticated diplomacy and its industrial base has badly atrophied through decades of offshoring and financialization. After mostly fighting insurgencies in recent times, it now has no idea how to fight a peer war. About all that it can muster is aid bills with large dollar figures. If all you have is a hammer, the old saying goes, every problem looks like a nail. If all you have left is a printing press for dollars, then every problem must be solvable by an infusion of money – even if it’s not entirely clear what that money can buy.

But here we have stumbled onto something interesting: a belief in the omnipotence of money. Perhaps not a sincere belief; are there any sincere beliefs in Washington? Let’s think of it more as an ingrained pattern of thought for confronting a wide range of problems. In that sense, it is a framework suspiciously reminiscent of the approach used to combat financial crises. It doesn’t seem like so much of a stretch to imagine the entire Ukraine aid discussion framed as something that has become very familiar in recent years: a financial bailout.

A too-big-to-fail financial institution called Ukraine is teetering on the edge of failure and a bailout is needed. Although the bank is far away from the heart of Wall Street, there are fears of contagion – if this one fails, others will follow and soon no bank anywhere will be safe. The bank’s owners may be crooks, but that is not what is preoccupying policymakers. They are nervous about a spread that has suddenly moved against the bank: it is supposed to trade at 1:1 but has blown out to 1:10 (the ratio of artillery fire by Ukrainian and Russian forces). Shoving a $60-billion bailout into the bank should at least put out the fires and calm markets.

Zoltan Poszar, the legendary former Credit Suisse chief strategist who needs no introduction in finance circles, made a fascinating observation on the topic of the reflexive response of throwing money at a problem. Poszar was speaking narrowly about how a certain group of people approach a certain problem and was not talking about policymaking, much less Ukraine, but his conclusion traces the contours of something deeper.

When the specter of inflation reemerged in 2021, Poszar made the rounds of portfolio managers and, after talking with them, reached an interesting conclusion: nobody knew how to think about inflation. Nearly everyone on Wall Street is too young to remember the last serious bout of inflation, which occurred way back in the 1980s. So, according to Poszar, they all thought of the spike in the inflation charts as just another spread that blew out on their Bloomberg screens that could be solved by throwing balance sheet at it – a “crisis of basis” as he calls it. The formative experiences for today’s denizens of Wall Street, Poszar explains, are the Asian financial crisis of 1998, the Great Financial Crisis of 2008, some spread blowouts since 2015, and the pandemic. In all of these cases, money was pumped in and eventually the dislocations disappeared.

To put this in plain English, Poszar’s clients hadn’t encountered a problem that couldn’t be solved – or at least swept under the rug – by simply adding money, in whatever form, whether via an emergency loan or quantitative easing. This is of course a bit of an oversimplification, but it captures something of the essence of the prevailing pattern of thought.

The seeds of failure are sown by the blooming flowers of success. The current generation of clowns have literally never encountered a problem that could not be solved by throwing money at it. All of their theoretical and practical knowledge points to the same solution: more money.

This is why the rise of the BRICSIA alternative to the USD, the CRIPS alternative to SWIFT, and the Belt and Road alternative to the IMF loansharks are potential death blows to Clown World. They have, in three fell swoops, essentially disarmed Clown World by taking its only weapon out of the equation.

I strongly suspect the fine hand of Wang Hunin in this long-term strategic approach.

DISCUSS ON SG