Dan Wang’s annual letter indicates that China is transcending the 18th Century conceptual framework that has resulted in the enslavement of the formerly Christian West to Satanic post-Christian torpor. While the West finds itself trapped in the outdated chains of self-serving Jewish interpretations of the Enlightenment philosophies, China is forging a more practical path forward by rejecting the most foundational assumptions of the failing neo-liberal world order.

An important factor in China’s reform program includes not only a willingness to reshape the strategic landscape—like promoting manufacturing over the internet—but also a discernment of which foreign trends to resist. These include excessive globalization and financialization. Beijing diagnosed the problems with financialization earlier than the US, where the problem is now endemic. The leadership is targeting a high level of manufacturing output, rejecting the notion of comparative advantage. That static model constructed by economists with the aim of seducing undergrads has leaked out of the lecture hall and morphed into a political justification for only watching as American communities of engineering practice dissolved. And Beijing today looks prescient for having kept out the US social media companies that continuously infuriate their home government.

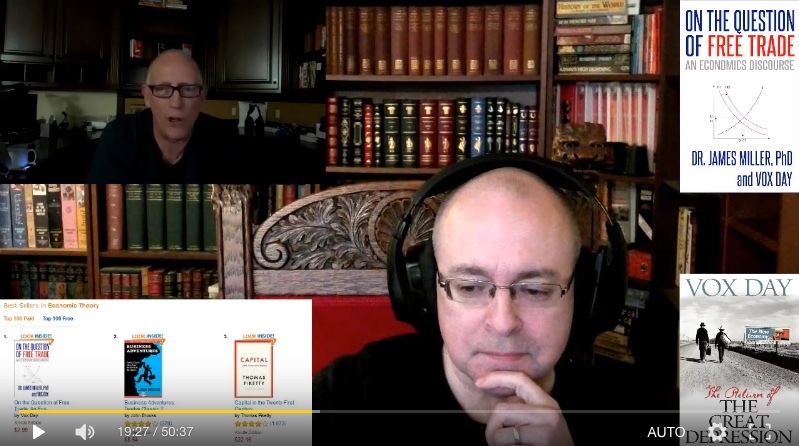

It’s interesting, is it not, to see how three years after I appeared on CGNT’s Dialogue and explained some of the fundamental flaws of Ricardian free trade on Chinese state television, and pointed out how the USA literally could not lose a trade war against China, that the CPC has explicitly rejected the orthodox classical concept of comparative advantage. I’m not saying that the case I explicated was the reason for that rejection, but it wouldn’t be surprising to learn that it was a contributing element, however minor.

It’s also clear that China is very likely to dominate the global economy going forward, as the USA sinks into a morass of meaningless conversations about conversations, and technology designed to enforce a rigid monoculture of SJW-approved goodthink.

Beijing recognizes that internet platforms make not only a great deal of money, but also many social problems. Consider online tutoring. The Ministry of Education claims to have surveyed 700,000 parents before it declared that the sector can no longer make profit. What was the industry profiting from? In the government’s view, education companies have become adept at monetizing the status anxieties of parents: the Zhang family keeps feeling outspent by the Li family, and vice versa. In a similar theme, the leadership considers the peer-to-peer lending industry as well as Ant Financial to be sources of financial risks; and video games to be a source of social harm. These companies may be profitable, but entrepreneurial dynamism here is not a good thing.

Where does Beijing prefer dynamism? Science-based industries that serve strategic needs. Beijing, in other words, is trying to make semiconductors sexy again. One might reasonably question how dealing pain to users of chips (like consumer internet firms) might help the industry. I think that the focus should instead be on talent and capital allocation. If venture capitalists are mostly funding social networking companies, then they would be able to hire the best talent while denying them to chipmakers. That has arguably been the story in Silicon Valley over the last decade: Intel and Cisco were not quite able to compete for the best engineering talent with Facebook and Google. Beijing wants to change this calculation among domestic investors and students at Peking and Tsinghua.

Internet platforms aren’t the only industries under suspicion. Beijing is also falling out of love with finance. It looks unwilling to let the vagaries of the financial markets dictate the pace of technological investment, which in the US has favored the internet over chips. Beijing has regularly denounced the “disorderly expansion of capital,” and sometimes its “barbaric growth.” The attitude of business-school types is to arbitrage everything that can be arbitraged no matter whether it serves social goals. That was directly Chen Yun’s fear that opportunists care only about money. High profits therefore are not the right metric to assess online education, because the industry is preying on anxious parents while immiserating their children.

Beijing’s attitude marks a difference with capitalism as it’s practiced in the US. Over the last two decades, the major American growth stories have been Silicon Valley (consumer internet and software) on one coast and Wall Street (financialization) on the other. For good measure, I’ll throw in a rejection of capitalism as it is practiced in the UK as well. My line last year triggered so many Brits that I’ll use it again: “With its emphasis on manufacturing, (China) cannot be like the UK, which is so successful in the sounding-clever industries—television, journalism, finance, and universities—while seeing a falling share of R&D intensity and a global loss of standing among its largest firms.”

As Michael Hudson has repeatedly demonstrated, financialization is fatal for both an economy and a society. It is fundamentally parasitical; it does not fertilize the growth of healthy productive companies, but rather, preys ruthlessly upon them and prevents them from growing to maturity.

The fact that the Chinese have consciously rejected the false promises of financialization and free trade is potentially one of the most important historic developments of the past 100 years.

DISCUSS ON SG