Apparently the foreign elite ruling the imperial USA are under the impression that the only way out of its Ukrainian debacle is through. Unfortunately, this concept doesn’t work when the rapidly approaching object is not a cloud, but the ground:

The House passed a foreign aid package on Saturday as well as what’s called the REPO Act that will allow the Biden administration to confiscate billions of dollars’ worth of Russian assets sitting in U.S. banks and transfer them to Ukraine for reconstruction.

“By delivering urgently needed aid to Ukraine, the United States has reasserted itself as the leader of the free world and as a reliable partner to its allies,” said Rep. Ritchie Torres, D-N.Y. “The US has a singular obligation to help freedom fighters fight for their freedom, and nowhere more so than in Ukraine, whose self-defense against Putin’s aggression must prevail.”

The REPO Act, which would authorize Biden to confiscate the frozen Russian assets in U.S. banks and transfer them to a special fund for Ukraine, is part of the foreign aid package that was stalled for months in the House. More than $6 billion of the $300 billion in frozen Russian assets are sitting in U.S. banks. Most of the $300 billion are in Germany, France and Belgium.

On Wednesday, Speaker of the House Mike Johnson released the package which would include tens of billions of dollars in aid for Ukraine, Israel, and Taiwan.

McFaul, whose been lobbying for the REPO Act for months, clapped back at Caldwell’s assertion and said the use of Russian assets for Ukraine would send an important message to autocratic nations around the world. “There are those that say, ‘Well, this will hurt the dollar. It’s bad for our reputation.’ I have a pushback to that. I don’t want criminals investing in American Treasury bonds,” McFaul said.

Keep three things in mind here. First, Russia has a similar amount in European funds frozen that it will seize in return if the Russian funds are stolen, as well as considerably more foreign assets that can be easily nationalized. As with the previous sanctions, this act will strengthen the Russian economy at the expense of the European economies.

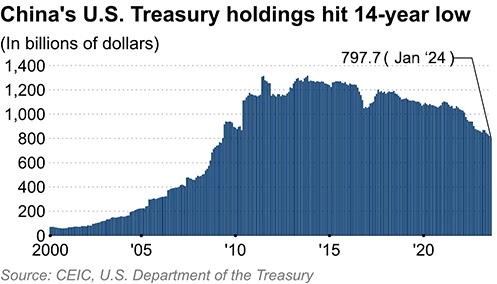

Second, China is already being sanctioned and is the second-largest holder of US Treasury bonds, at $800 billion. This is 40 percent lower than it was 11 years ago and is a 14-year low. This is one reason why the USA has been unable to export inflation the way it used to, and if China were to follow Russia’s lead in dumping the dollar entirely, US inflation would probably double from where it is today. Since the BRICSIA nations are already in the process of developing their own trading currency, this is a very high probability event within the next three years and will probably precede the opening of the Asian front.

And third, the central banks are, quite literally, criminal organizations, as are most of the large multinational corporations. If criminals weren’t investing in US Treasury bonds, no one would be. Furthermore, the seizure of foreign assets without full compensation would obviously be nothing less than theft by the U.S. Congress.

I suspect there may be some serious unintended consequences for the global banking system if the bill actually becomes a law and is translated into action. Because how can anyone possibly trust their financial assets to a banking system so easily suborned to a government’s whims?