Americans have always tended to look down on Canadians as being nice, but ineffectual people, on average. It appears, however, that their political class is even more self-destructive than their European counterparts:

Donald Trump continued his budding trade war with Canada by pledging to ‘just get it all back’ with stiffer reciprocal tariffs next month – as Ontario Premier Doug Ford threatened to knock his lights out. Ford has already followed through on a promise to put a 25% tariff on Canadian electricity to Michigan, New York and Minnesota on Monday.

The Ontario premier, who runs Canada’s most populous province, now says he’s ready to ‘shut the electricity off completely’ if America continues to ‘escalate.’

Trump has shot back, mocking Ford’s plan and saying that his promise of reciprocal tariffs will render anything Ontario does useless.

‘Despite the fact that Canada is charging the USA from 250% to 390% Tariffs on many of our farm products, Ontario just announced a 25% surcharge on ‘electricity,’ of all things, and you’re not even allowed to do that,’ he said in a Truth Social.

However, Trump said that the US will ‘just get it all back on April 2,’ when the administration’s reciprocal tariff plan goes into effect. Trump continued to take shots at his neighbors to the north before declaring he was on the way to making America great again.

‘Canada is a Tariff abuser, and always has been, but the United States is not going to be subsidizing Canada any longer. We don’t need your Cars, we don’t need your Lumber, we don’t your Energy, and very soon, you will find that out,’ he promised.

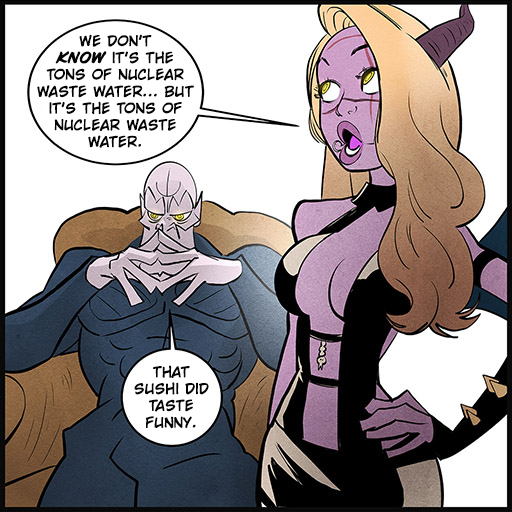

This is the danger of believing the rhetoric of your corrupt Clown World advisors and taking it literally. All of these political figures threatening to respond in kind to US tariffs quite clearly don’t understand the basic economic math involved.

While Canada can hurt a few specific economic sectors, the overall benefit to the USA of complete autarky is significant. Therefore, any escalation of a tariff war between the USA and Canada only makes it more profitable to the USA and more costly to Canada. The same is true of Mexico, China, Japan, and every other country that runs a trade surplus with the USA.

Japan, at least, understands this, and is seeking to avoid making things worse for itself.

Japan’s trade minister said Tuesday that he has failed to win assurances from U.S. officials that the key U.S. ally will be exempt from tariffs, some of which go onto effect on Wednesday. Yoji Muto was in Washington for last ditch negotiations over the tariffs on a range of Japanese exports including cars, steel and aluminum. Muto said Tuesday that Japan, which contributes to the U.S. economy by heavily investing and creating jobs in the United States, “should not be subject to” 25% tariffs on steel, aluminum and auto exports to America.

You’ll notice Japan hasn’t been doing anything stupid like threatening to add to its already significant list of obstacles to US imports.

UPDATE: The God-Emperor 2.0 didn’t waste any time before dropping the hammer.

President Donald Trump declared a national emergency on electricity in the United States and doubled the tariffs on aluminum and steel from Canada after retaliatory tariffs from America’s neighbor to the north. Trump also warned more auto tariffs are coming on April 2nd. He wants Canada to drop its retaliatory tariffs on U.S. dairy and agricultural products.

‘If other egregious, long time Tariffs are not likewise dropped by Canada, I will substantially increase, on April 2nd, the Tariffs on Cars coming into the U.S. which will, essentially, permanently shut down the automobile manufacturing business in Canada,’ he said.

It’s mildly amusing to observe the media trying to cry about how US tariffs are bad while simultaneously refusing to acknowledge the fact that they are a response to Canadian tariffs on US products that have long been in place.