The economic history, that is. I’m not a bankster, so it must be the tiger’s blood. Regardless, RGD is the #1 ebook in Economic History.

Tag: economics

Be prepared

Since it doesn’t do to wing it before discussing economics with someone who has a reasonably sophisticated grasp on the subject, I thought I had better acquaint myself with the latest statistical updates before attempting to talk about them in public. What is interesting to note in all of this recent inflation hysteria is that the rate of increase of the CPI-U measure of price changes and the M2 money supply measure are both presently below their 50-year average. Below is a chart showing the change in CPI-U and M2 on a monthly basis since January 2008.

The average annual growth over this period is 1.44% for CPI-U and 6.16% for M2. That sounds like a lot, but to put it in perspective, the average annual growth over the 51 years from January 1960 to January 2011 is 4.13% for CPI-U and 6.86% for M2. It’s far below the record three-year periods of 1978-1980 in which CPI-U averaged 11.6% growth per year, or when M2 growth averaged 12.2% growth in 1977-1979. And while it is absolutely correct to doubt the veracity of these government-published figures – anyone who goes through the M2 statistics won’t miss the discrepancy between various H6 reports for the exact same month – but since these statistics are being used to support the inflationary case, the fact that they are not increasing at an unusually rapid rate must be taken into account.

The average annual growth over this period is 1.44% for CPI-U and 6.16% for M2. That sounds like a lot, but to put it in perspective, the average annual growth over the 51 years from January 1960 to January 2011 is 4.13% for CPI-U and 6.86% for M2. It’s far below the record three-year periods of 1978-1980 in which CPI-U averaged 11.6% growth per year, or when M2 growth averaged 12.2% growth in 1977-1979. And while it is absolutely correct to doubt the veracity of these government-published figures – anyone who goes through the M2 statistics won’t miss the discrepancy between various H6 reports for the exact same month – but since these statistics are being used to support the inflationary case, the fact that they are not increasing at an unusually rapid rate must be taken into account.

It hasn’t escaped my attention that gold, oil, and commodity prices are all increasing. Neither have I failed to note that other prices are continuing to fall. The collapse of housing prices, down 31.4% from their 2006 Case-Schiller peak and falling at an annual average rate of 7.9% over the three years covered in the chart above, are much more indicative of a deflationary environment rather than an inflationary one. How do we balance these contradictory indications? I expect that is a question that Mr. Schiff will probably want to discuss.

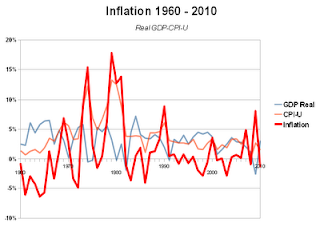

Now, in the video entitled Four Keynesian Inflations, I explain why attempting to measure inflation in terms of CPI and GDP makes absolutely no sense, despite the fact that this is how the financial media always describes it. But, even if we accept the idea that inflation is the rate of dollar price changes (CPI) in excess of the rate of economic growth measured in dollars (GDP), it should be obvious from the chart entitled Inflation 1960-2010, which subtracts Real GDP from CPI-U, that inflation is neither at a historically high level nor is it even increasing at the moment. I think the chart demonstrates even more clearly that the Samuelsonian metrics involved are almost completely worthless as they clearly do not measure what they purport to measure, but since they presently frame the context of the mainstream economic analysis, it is necessary to take them into account.

Now, in the video entitled Four Keynesian Inflations, I explain why attempting to measure inflation in terms of CPI and GDP makes absolutely no sense, despite the fact that this is how the financial media always describes it. But, even if we accept the idea that inflation is the rate of dollar price changes (CPI) in excess of the rate of economic growth measured in dollars (GDP), it should be obvious from the chart entitled Inflation 1960-2010, which subtracts Real GDP from CPI-U, that inflation is neither at a historically high level nor is it even increasing at the moment. I think the chart demonstrates even more clearly that the Samuelsonian metrics involved are almost completely worthless as they clearly do not measure what they purport to measure, but since they presently frame the context of the mainstream economic analysis, it is necessary to take them into account.

Since we’re apparently also going to be discussing Federal Reserve Chairman Ben Bernanke, it may be helpful to read his most recent report to the Congress if you want to follow along.

Attn: inflationistas

Name of Guest: Vox Day

Date: Thursday, March 3, 2011

Interview Start Time: 10:35 AM ET

Interview End Time: 11:00 AM ET

Program Name: The Peter Schiff Show

Host: Peter Schiff

Topic: Ben Bernanke and the debate over inflation.

Just in case you’re interested. You can listen live here.

Where is the depression?

Occasionally economically ignorant critics attempt to nip at my ankles by making reference to the apparent absence of the global economic contraction that I believe is happening and predicted would start to become widely recognized by the end of 2010. But the failure of the Great Depression 2.0 to be recognized in the conventional macroeconomic statistics yet doesn’t bother me in the slightest, because the map is not the territory. And, as I demonstrate in the chapter entitled “No One Knows Anything”, those statistics cannot be trusted in the least. Keep in mind that the National Association of Realtors is having to revise its numbers to account for the 3.1 million home sales that were reported by its statistical model in 2009 and 2010 but cannot be found in any real-world recording process; a similar correction to GDP would indicate a 30 percent decline from $14,870 billion to $10,306 billion. It’s interesting to see how this is roughly in line with the confidential Goldman Sachs report cited by the Market Ticker.

What have I been saying? That the only thing keeping us from recognizing a full-on economic depression was government deficit spending? Spending that, at present levels, cannot possibly continue.

Worse, there’s no way out of the box. Raise taxes and you subtract directly from private spending. Refuse to raise taxes and you are forced to continue to borrow. Extrapolate out the $1.7 trillion from calendar 2010 and removing that would result in a decrease of twenty-eight times Goldman’s estimate, or some fifty percent of GDP.

Were you sitting down when you read that? Did you have an incontinent moment? If you didn’t then you don’t believe Goldman’s confidential report. If you do believe it you now know what’s going to happen. Not might, will.

One way or another, the artificial support to GDP that is embedded in our insane deficit spending will stop. It mathematically must stop. And when it does stop, if you believe Goldman’s analysis, even if we only cut deficit spending in half GDP will fall by 25%. If we eliminate it? GDP is halved.

And there, my dear critics, is precisely where your missing depression is. I don’t mind admitting that the Fed has been able to keep the situation strung together with string and chewing gum longer than I thought they could, but it doesn’t matter if they manage to keep it up for another five years. The end result will still be the same. Although it’s not quite correct to say that it doesn’t matter, as the longer they manage to postpone the inevitable, the more painful it is going to be.

Socionomics told us 10 years ago that there we were going to be seeing a huge increase in violent political upheaval around the world. That’s exactly what we’re seeing now across the Middle East, but don’t think that it is going to end there. Once the desperation spending stops, it’s going to spread across the East and West as well. We’re not talking cannibalism in the streets, but we’re also not talking about a stroll in the park either. But just so we’re clear, I expect at least one more round of stimulus, and probably two, before the Keynesians throw in the towel. This indicates that Republicans will eventually cave on the debt ceiling; given their strong rhetoric there will have to be some sort of crisis that will excuse the abandonment of their position.

Overstated

Long-time readers will recall that NAR Chief Economist has been my bitch for the last two years that I made existing home sale price predictions. So, you can probably understand that I was amused at the news that the basic NAR model badly wants revision:

Case-Shiller also released its quarterly index covering all homes in the country. It showed prices fell 3.9 percent in the fourth quarter and 4.1 percent for all of 2010. All of that may be the good news. The bad news is the Wall Street Journal reports that the National Association of Realtors may have been overstating existing home sale figures as far back as 2007.

“The group reported that there were 4.9 million sales of previously owned homes in 2010, down 5.7% from 5.2 million in 2009. But CoreLogic, a real-estate analytics firm based in Santa Ana, Calif., counted just 3.3 million homes sales last year, a drop of 10.8% from 3.7 million in 2009. CoreLogic says NAR could have overstated home sales by as much as 20%.

If the Realtors have overstated sales, the existing overhang of unsold homes is even greater than what’s been thought.

In determining annual sales numbers the Realtors have been using a model “that is benchmarked to the figures reported in the decennial U.S. Census. The model requires making certain assumptions for population growth and other measures in between the census surveys,” reports the WSJ.

The model may have overstated the number of sales “due to recent consolidation among multiple-listing services, which has resulted in those firms having wider coverage of housing markets. NAR’s tally could be distorted if the firms ‘are sending us more home sales because they have a larger coverage area, but without informing us that their reach has grown,’” said Lawrence Yun, who is the chief economist at NAR and the one keeping an eye on the model.

Needless to say, if they overstated the sales numbers, there is a very good chance that they overstated the average prices paid as well. Once more, it looks as if I was insufficiently pessimistic in RGD, positive GDP reports notwithstanding. Of course, now that we’ve brought up the subject of erroneous statistical reports….

The economic contraction isn’t over. It has still barely begun.

Fortunately, deficits don’t matter

For Paul Samuelson told us so:

President Obama‘s budget, released Monday, was conceived as a blueprint for future spending, but it also paints the bleakest picture yet of the current fiscal year, which is on track for a record federal deficit and will see the government’s overall debt surpass the size of the total U.S. economy. Mr. Obama‘s budget projects that 2011 will see the biggest one-year debt jump in history, or nearly $2 trillion, to reach $15.476 trillion by Sept. 30, the end of the fiscal year. That would be 102.6 percent of GDP — the first time since World War II that dubious figure has been reached.

Neo-Keynesians such as Paul Krugman insist that the deficit isn’t a problem because of this line of argument, first presented by Paul Samuelson in his landmark 1948 textbook entitled “Economics”.

“There are also burdens involved in an internally held public debt like our present one, but the burdens of an internal debt are qualitatively and quantitatively different from those of an external debt. This is the first and most important lesson to be grasped, without which nobody can go far in understanding the economics of the public debt. The interest on an internal debt is paid by Americans to Americans; there is no direct loss of goods and services. When interest on the debt is paid out of taxation, there is no direct loss of disposable income; Paul receives what Peter loses, and sometimes – but only sometimes – Paul and Peter are one and the same person. . . . In the future, some of our grandchildren will be giving up goods and services to other grandchildren. That is the nub of the matter. The only way we can impose a direct burden on the future nation as a whole is by incurring an external debt or by passing along less capital equipment to posterity.

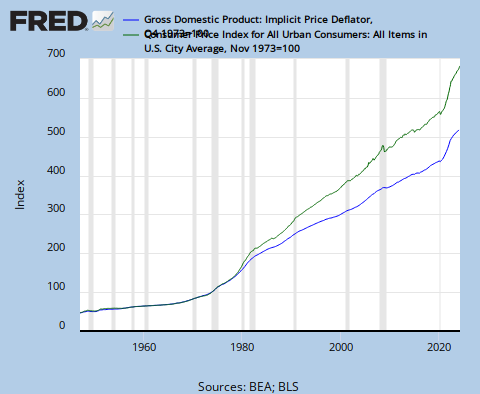

Of course, it is probably worth considering that the situation in 2011 is not exactly the same as the situation in 1948, as can be seen in the chart below. Note the green line, in particular.

Mailvox: the Fed evades

JH asks a Federal Reserve official about the decline in private borrowing:

I solicited advice from you quite a while ago on a debt deflation question to ask a Fed Reserve speaker at a work function, and as you predicted, he pretty much dismissed drawing any conclusions from the Fed Z1 report which showed that without government debt growth the US was in severe debt contraction. The speaker said the contraction was a temporary result of there not being enough good people or businesses worth investing in presently. On some level this may be true, but he still completely avoided discussing the implications of continued credit contraction to the overall economy.

It’s a pity JH wasn’t allowed a follow-up question, as the obvious one was as follows: how do you explain this “temporary result of there not being enough good people or businesses worth investing in presently” in light of the fact that a) there are more people in the USA than ever before, and b) the fact that there has NEVER been a comparable contraction in private credit in the post-war era.

The other question I would have liked to ask the Fed official is this. How long do you think government sector credit can continue to expand and prevent Z1 from falling if the household and financial sectors continue to decline?

Well, Hitler was from Austria….

Oh sweet Mises, even Krugman at his most obstinately ignorant hasn’t descended to these depths regarding the Austrian School of Economics:

Ever wonder how one of the most educated and advanced nation in Europe ended up with Hitler as a leader in 1933? Well, you have thank Austrian Economics for that- at least partially. You see, after ww1 the allies made Germans pay exorbitant and ruinous reparations. The only way to escape these compensations was through hyperinflation- wiemar style.

But here is the fun part.. after a few years of such hyperinflation they decided to cool down and “normalize” the economy- using the advice of people like Friedrich von Hayek and his “Austrian” School Of Economics. The guy who led this effort, Heinrich Brüning, whose austerity measures resulted in a massive increase in unemployment- from 15% to over 30% in less than two years.

No, you really don’t. At all. The Austrian School of economics had as much to do with the rise of the National Socialists to power in Germany as Victoria’s Secret or My Pretty Pony did. First, as anyone who has ever read The Economic Consequences of the Peace will know, hyperinflation was not only a predictable consequence of the war reparations, but could not be utilized to reduce the German debt because it was subject to recalculations that were completely under the control of the Allied commission. Inflating their way out of the debt was never an option for the Germans; there was no escape except default. This was already obvious to everyone back in 1929, which is why the Young plan reduced the reparations payments and was followed by a moratorium in 1931. Note that the Young plan went into effect three months before Brüning even took office for the first time. Second, Austrian economics had no influence on German politics, which was dominated by socialism of varying stripes. In fact, the very name “Austrian” was given as a deprecating insult to the school by the empiricists of the dominant German Historical School during the Methodenstreit at the end of the 19th century.

Third, Heinrich Brüning’s attempt to rein in the Weimar hyperinflation was not based on Friedrich von Hayek’s advice. Hayek and the Austrians were hardly the first to notice the pernicious effects of inflation and Hayek didn’t even publish his first book until 1929. Moreover, he was in London at the London School of Economics while Brüning was Chancellor of the Weimar Republic. The ironic thing is that this inept Advocatus Diaboli appears to think that Brüning should have pursued a Keynesian approach, nowithstanding the fact that the the German edition of The General Theory of Employment, Interest, and Mony was not published until September 1936, four years after Brüning left office. Keynes’s own words on the German economic tradition during the period that included the Weimar years are also somewhat pertinent to the subject:

“The orthodox tradition, which ruled in nineteenth century England, never took so firm a hold of German thought. There have always existed important schools of economists in Germany who have strongly disputed the adequacy of the classical theory for the analysis of contemporary events. The Manchester School and Marxism both derive ultimately from Ricardo, a conclusion which is only superficially surprising. But in Germany there has always existed a large section of opinion which has adhered neither to the one nor to the other. It can scarcely be claimed, however, that this school of thought has erected a rival theoretical construction; or has even attempted to do so. It has been sceptical, realistic, content with historical and empirical methods and results, which discard formal analysis…. Thus Germany, quite contrary to her habit in most of the sciences, has been content for a whole century to do without any formal theory of economics which was predominant and generally accepted.”

Keynes is describing the importance of the Historical School here, the same German Historical School that gave the name to its provincial theoretical rivals. Attempting to blame the end of Weimar hyperinflation, much less the rise of Adolf Hitler, on the Austrian school or even the slightly more plausible Manchester school reveals a near-complete ignorance of economic history.

Krugman catches up

What’s going on here? It means that we’re either overstating inflation (and hence understating income gains) or overstating economic growth. Both the BEA (which measures GDP and related) and the BLS (which does consumer prices) work hard and honestly at their tasks; the difference probably arises (I’m sure someone has done this more carefully) in how you value new or improved goods. My sense has always been that the GDP accounts overdo their hedonics, but that’s very much a matter of opinion. Maybe the real point here is to remember, always, that economic statistics are a peculiarly boring sub-genre of science fiction; extremely useful, but not to be treated as absolute truth.

From RGD Chapter 4, No One Knows Anything: “Another indication that GDP growth may be exaggerated stems from comparing the data for the GDP deflator, which purports to correct GDP for inflation, with the Consumer Price Index, which is more commonly used as the primary measure of inflation. If one chooses 1983, the base year of index to which all of the historical CPI data are chained, one will find that the GDP deflator reports inflation of 79.1 percent over the last 26 years, while the CPI figure shows 114.1 percent inflation over the same period. While the two statistical measures are based on different criteria, their comparison shows the inverse of what one would tend to expect since CPI reflects the price of imported goods while the GDP deflator does not. And, as anyone who has been paying attention to the balance of trade over the last two decades will recognize, foreign imports tend to cost less than domestically manufactured products. Another oddity is the way in which an increase in the price of imported oil reduces the GDP deflator, thereby exaggerating GDP growth when the price of oil rises and reducing it when it drops. It’s interesting to note that when GDP is corrected for inflation using the CPI rather than the deflator, the real U.S. economy appears to be significantly smaller than it is presently believed to be. For example, whereas the GDP deflator shows growth from $3.1 trillion to $8.0 trillion over the last 26 years in 1983 dollars, using GDP-CPI would indicate a real 2009 GDP of only $6.6 trillion.”

My conclusion, of course, is that inflation has been erroneously defined and economic growth has been significantly overstated. This will become readily apparent once it is no longer possible to conceal the bad debts that are still being recorded as positive assets on the corporate and government books. And it is more than a little amusing to see Krugman admit that economic statistics are “a sub-genre of science fiction” and “not to be treated as absolute truth” considering the way in which he attempts to use them to macromanage the global economy.

Mailvox: the inactive aspect of demand

Jed requests an explanation:

Vox, can you explain [that “not buying something is at least potentially an economic activity”]?

How is not playing baseball considered playing baseball when one is merely sitting in the stands? This only works from a socialistic standpoint which is exactly why Democrats saw no problem including it in their law.

First, the baseball analogy is a bad one. The logical error that Jed commits there is his assumption that economic activity = buying something. This is not only incorrect, since X!=not X, but indicates a failure to understand what economics is. This failure is further evidenced by the incoherent assertion that it “only works from a socialistic standpoint”, whereas the truth is that because economic concepts always work, socialism itself does not.

Now for the explanation. Recall the basic supply and demand curve. Since the demand curve is the expression of the buyers’ willingness to buy at various price points, it by definition takes into account the decisions of those who are actively choosing not to buy at a price above their buy point. They are engaging in exactly the same economic activity in not-buying that they are in buying, the only difference is that the price point happen to be above their action trigger.

This isn’t as confusing as it sounds at first. For example, no one has a hard time understanding that a woman has gone shopping even if she didn’t end up buying anything while she was out at the mall. This is why, in the introduction to RGD, I pointed out that Leonard Read’s famous story of the pencil only told half the story as “The story on the demand side is arguably even more amazing, as the myriad assignments of personal value for a pencil made by the millions of people who buy pencils and by the tens of millions who elect not to buy them are all factored into an incredibly massive but ever-changing computation that always manages to produce a definite price for every single transaction that takes place at millions of different points in the space-time continuum.”

This doesn’t mean that every non-purchase can be considered economic activity, only decisions to not make a possible purchase can. One has to be somewhere along the demand curve in order to qualify. Thus, a decision to not purchase U.S. health insurance by someone in Indonesia is not economic activity because the Indonesian is not a potential participant in that market. But the decision by individuals in Chicago or Raleigh to not purchase health insurance is economic activity because they are potential participants in the market since they would be interested in purchasing health insurance if the price fell low enough.

Now, none of this can be used to justify the Commerce Clause given the principle of non-infinity and the fact that it is supposed to be a specific exception to a restriction, not a free Federal do whatever the hell you want card. But the basic concept of the non-buyer as economic participant is a perfectly sound one.