Less than five years after founder Aaron Schatz sold the popular Football Outsiders site, it’s dead, done, and dusted.

Football Outsiders was founded in 2003 by Aaron Schatz. What began as his passion project grew into a fully fledged website for advanced football analytics and statistics such as DVOA (Defense-adjusted Value Over Average). Football Outsiders went on to strike partnerships with ESPN and became a popular source for hardcore football nerds and casual fans alike. In 2018, Schatz sold Football Outsiders to a company called EdjSports. He stayed on as editor-in-chief, and, according to longtime Football Outsiders writer Mike Tanier, the site continued to operate as normal.

Then, in September 2021, Champion Gaming, co-founded by Simmonds and Hershman, entered the picture. It acquired EdjSports, and Football Outsiders along with it, in late 2021 as part of a “reverse takeover,” a way for private companies to go public quickly without having to go through an Initial Public Offering. As part of the deal, Champion Gaming merged with a shell company called Prime City One Capital. According to a news report from the time, “the group closed a funding round of $3.65 million (CAD $4.62 million), giving it a roughly $12.3 million post-money valuation, and it is on track to begin trading in a few weeks.”

Champion Gaming had ambitions to expand beyond NFL coverage. It struck a licensing deal with Inpredictable, an NBA analytics website run by Mike Beuoy, and partnered with SharpRank, a sports betting resource. The terms and status of these partnerships are unclear; Beuoy and SharpRank did not respond to queries. Champion Gaming also brought on Chris Spagnuolo to oversee content (for a particular microgeneration of sports media consumers, Spagnuolo is best known as the guy who left Barstool Sports after writing a blog calling Rihanna fat), and hired ESPN’s Katie George to be a brand ambassador and create video content. Spagnuolo declined to comment. Defector was not able to reach George for comment.

By the summer after the takeover, changes at the top of the company were underway. In June 2022, Simmonds took over from Hershman as CEO; Wickham took over as CFO; and the company’s president, Chief Innovation Officer, and director all resigned. The company framed the changes as an exciting new chapter. Of Simmonds’s ascent to CEO, Hershman said in a press release, “Given his previous experience as a public markets CEO and his extensive background in online gambling, the board of directors and I determined that his leadership of the Company would be both ideal and appropriate to steer us going forward as we build a leading sports content and data intelligence business.”

But by the fall there were signs that the company was floundering. According to financial documents filed in November 2022, which are publicly available through Sedar, Canada’s securities filing system, the company had little cash flow and was carrying significant debt, especially relative to its revenues. In the first nine months of 2022, Champion Gaming reported $969,789 in revenue and $5,619,803 in losses. (All monetary figures cited in the filings are in CAD.) As of Sept. 30, 2022, the entire company had only $55,776 in cash, with even less coming in. As of the same date, the accounts receivable, meaning revenue the company accrued, but which they still needed to be paid, was only $13,911. On page six of the same filing, the company wrote: “These material uncertainties cast significant doubt as to the Company’s ability to continue as a going concern.”

The company’s main form of cash flow came from issuing equity and borrowing money.

Now, if your sole focus is money, it may make sense to literally sell out. Schatz probably made a nice bit from the initial sale, although he didn’t make the big score that would have resulted from the money guys going public or selling it to a big public corporation would have.

An operation like FO, despite its popularity, never makes all that much money. A million dollars sounds like a lot, but FO probably didn’t do much more than provide a reasonable living to its owners due to the need to pay for all the contract-based content produced. And as usual, the people who practically invented the NFL analytics game are about the only ones not profiting much from it.

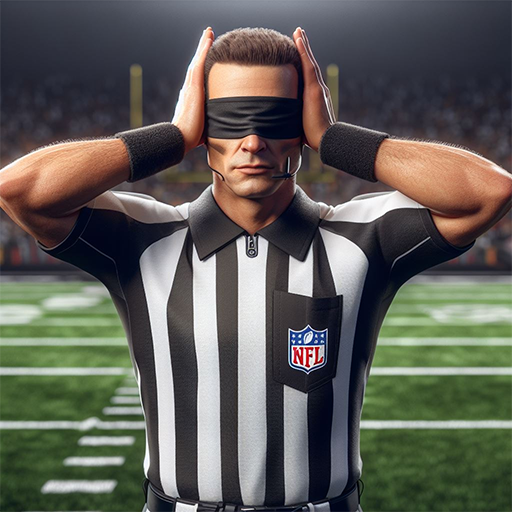

“It’s just really disheartening to see this niche, special interest, really passionate sports blog that blossomed into a pretty influential sports analytics company, just get sucked dry so quickly,”

It is always disheartening to see how quickly, and how comprehensively, the financial parasites manage to destroy great little companies. So if you’re doing what you love, if it’s truly a passion, why sell out and run the very high risk of seeing your creation destroyed? For every sell-out that scores big, there are probably ten or more that end up dessicated, defunct, and forgotten. It’s amazing how many organizations that could have continued doing what they were doing almost indefnitely have disappeared as a result of cashing in and cashing out.

That’s one reason why Castalia subscribers need not worry about their source of world-class leather books going away, as long as enough people continue to subscribe to it. I am fully aware of the realities of the merger and acquisition market, which is why I won’t even agree to have “a conversation” with the financial pirates when they “reach out” to see if we’re interested in “exploring mutual opportunities”.

And speaking of Castalia, I would be remiss if I did not point out that CARAVAN OF THE DAMNED, Chuck Dixon’s Conan #2, is back in stock on Amazon.

Anyhow, at the end of the day, a man needs to ask himself: what is my purpose? And also, is money a necessary evil or is it the prime objective?

UPDATE: Caravan has also reached the fulfilment house for those who bought direct. The cover colors look brilliant.

DISCUSS ON SG