The author of Princes of the Yen, which presciently predicted the 2008 financial crisis, the current one, and the global currency goal as far back as 2005, was methodically demolishing all of the key narratives supporting Clown World’s economic structures eight years ago:

The first four pillars of the central banking narrative have collapsed: Banks create money out of nothing and thus reshape the economy in their image. Markets are rationed and the key factor is the quantity of bank credit. Bank credit creation for GDP transactions boosts GDP growth, no matter what interest rates do (they will follow GDP growth). Developing countries do not need to borrow from abroad, and in fact should not borrow from abroad, as this puts them unnecessarily at mercy of the foreign creditors.

As these pillars revolve around banks and money and credit, some economists may agree, but argue that economics has long focused on the real economy and purposely chose to ignore all the financial factors. In this real economy, they will argue, the most important principle is to allow market forces to act without being hampered by governments – then we will see economic growth and stability. Should this fifth pillar of the central banking narrative at least be true?

Judging by the publications of the central banks, as well as the IMF or the World Bank, one would expect so: When these Washington-based institutions send their teams of staff and hired consultants to developing countries, their job can usually be completed very quickly. Without much ado, a new country report complete with major policy conclusions is drafted. The secret of such efficient work: even before these foreign experts had travelled (first class) to the respective countries, the conclusions of their study had already been pre-determined, because they are always the same, no matter which country is concerned: The goal of the axiomatic-deductive neoclassical belief system is to find ex post justifications for the argument that government intervention is bad, and markets need to be unfettered by any form of intervention. This predetermined conclusion is then presented, in the form of ‘research reports’ or ‘studies’, to the leadership of many nations across the world, only vaguely connected to local facts and institutions.

In order to reach such conclusions, neoclassical and central bank economists worked backwards: What kind of model comes to such conclusions? Answer: A model that operates in a dream-like idealized world. What are the features that define such a world? A long list of assumptions needs to hold, creating a bizarre theoretical Neverland: perfect information, complete markets in equilibrium, perfect competition, zero transaction costs, no time constraints, perfectly flexible prices that adjust all the time, everyone is very selfish and does not care about others, and people are not influenced by others. Why do all these assumptions matter? Because neoclassical economists have proven that they all need to jointly hold true, for market equilibrium and efficient markets to exist, and for government intervention to be ineffective.

The next step in the sequence of using such models is the most important one: present in reverse order, by pretending that no pre-determined conclusions existed. Start by listing the assumptions – for sake of argument. Then present the model. Then pursue it to its conclusions, which happen to be… let’s see… Oh, amazing: this model happens to conclude government intervention is bad and only free and deregulated markets will work! Well, in that case, ladies and gentlemen, we shall need to recommend deregulation, liberalization and privatization!

That such economic charlatanry passes for ‘economics’ in leading journals, textbooks and university lecture rooms is a sad indictment not only of the economics establishment, but of academia and society at large.

But what about economies in our world, on the planet we live – as opposed to the bizarre planet described by the economic charlatans? Since none of these assumptions hold, we know that we can neither expect equilibrium nor will deregulation, liberalization and privatization trigger improved economic growth.

If our theoretical assessment of the theoretical claims is correct, we should also be able to muster empirical support for it. And it exists in abundance. In order to test these neo-classical policy recommendations of deregulation and market supremacy, we can compare the market-oriented and shareholder value-focused US and UK economies with those economies known to have always placed an emphasis on government intervention, non-market forms of resource allocation combined with social welfare systems, namely Germany, Japan, Korea, Taiwan and China. Of course we should not be influenced by the business cycle, and thus need to consider a longer time period, such as half a century. Considering therefore the half-century from 1950 to 2000, we would expect the best performance in those economies that are more market-oriented, and the worst performance in economies that have chosen to practice intervention, ‘guidance’ and the use of production cartels. What is the empirical result?

The neoclassical thesis has been rejected by the empirical evidence. In the 1950s, the designers of the Japanese economic system intentionally increased the number of cartels, in order to improve economic performance (Werner, 2003a). As we can see, as the number of cartels almost doubled to over 1000 by the late 1960s, while economic growth accelerated to double-digit figures. When, under US pressure, the number of cartels was reduced in the 1970s, growth dropped. The drop in cartels is accompanied by weaker and weaker economic growth. The deregulation drive culminated in the entire abolition of cartels by the end of the 1990s – and economic growth equally reached zero. A similar picture has been painted by the performance of many developing countries, including Argentina and African nations, which followed the economic advice of the Washington-based institutions. We conclude that the fifth of the central bank claims – that deregulation, liberalization and privatization enhances economic growth – has also been revealed to be fraudulent.

Do we Need Central Banks? RICHARD WERNER 15 January 2017

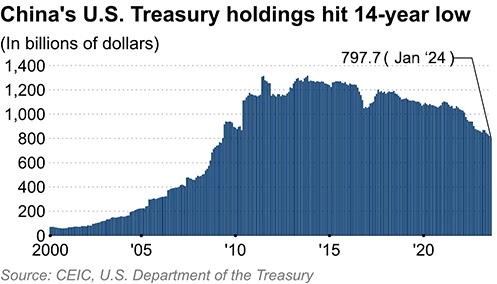

What’s intriguing about both his book as well as his paper is that it explains why both China and Russia are economically routing the bank-controlled economies of the West as well as why Japan is behaving so erratically and in such an uncharacteristic manner of late.

The great deception of liberals, libertarians, conservatives, and independence-minded Americans in general is the idea that corporate management is good and government management is bad. But the so-called Invisible Hand not only doesn’t exist, it perpetuates a gargantuan lie that directly serves the interests of the globalists, who delight in transnationalist unaccountability.

I haven’t read the book yet. But I will, especially since he is obviously far ahead of the game on the realities of how money is actually created in a modern credit economy. Ian Fletcher and I have proven Ricardo was completely wrong. Steve Keen has proven Smith was generally incorrect. So, it should come as no surprise that someone of our intellectual generation would eventually prove that Friedman was wrong as well.

At this point, it’s hardly arguable that none of us are actually free to choose very much of anything at all.