Karl Denninger explains why businesses – indeed, entire industries – that work as long as credit is expanding fail rapidly once the debt-money supply begins to contract:

In a bubble economy, where the government is pressing new credit into the hands of the public, directly and indirectly, every business plan looks good.

When the impact of that action turns back into inflation, and it always does, wherever that inflation shows up ultimately detonates every one of those firms.

The truth is that every firm is only stable on an continuing concern basis if it can sell its goods and services at a profit without said excess credit creation.

If it can’t then the business model is bankrupt and said temporary success only occurred because of a scam, whether the firm was doing the scamming or they were riding a government scam.

One of the latest examples is “Toast”, which is a company that provides POS systems to restaurants and bars. You’ve probably seen it; I have, several times. They were a “darling” in the space and quite-rapidly took over, providing various services including online ordering. During the pandemic this looked really attractive to places that were not part of a national chain in that it “gave” them said online ordering presence that they otherwise wouldn’t have and couldn’t afford to individually develop.

The problem is that the company, which is publicly traded, is losing money. They partnered with Google and that apparently brought in less than it cost (gee, go figure, you all tried to ride the money-printing wave that came with the pandemic) and now they’ve added a “processing fee” behind the back of restaurants on online orders.

This is likely illegal, incidentally, and definitely is if not disclosed appropriately before the customer places the order. Further it may well breach the implied warranty of fair dealing with the restaurant which neither gets any of the fee nor were they apparently part of a negotiation to add it when they signed their service contract — this appears, from the above-linked story, to be something the firm unilaterally added.

But that’s the sort of thing that happens when you have a bankrupt business model that only “works” due to inflationary credit emission by the government, you appear to be “doing well” and then the inflation rebounds into your face and suddenly you have a big fat net loss.

The same sort of crap went on with the so-called “short-term rental” arbitrage market — AirBNB and VRBO, to name two of several. The embedded costs in this, including the platform fees, cleaning charges that someone has to eat between guests and similar, along with the pure arbitrage nature of these transactions in that the places being rented are neither built or maintained to commercial occupancy standards is obvious. This looks like a good deal but it only is due to inflationary credit creation; the business model is inherently bankrupt as the overhead exceeds that, by quite a bit, of a hotel or other lodging arrangement if the arbitrage and overhead costs are not available to be hidden via said credit creation. The belief in “free” feeds back into property prices which results in a further inflationary price spiral — this time in the acquisition price of said properties.

The reason these businesses tend to collapse so fast is because they live right on the edge. They’re always expanding as rapidly as they can, and funding that growth with debt, so the minute that either a) the growth slows or b) the cost of debt service rises, they can’t afford to continue servicing the debt and the business goes straight into bankruptcy despite being generally sound and profitable at the operational level.

This is why I don’t advocate using debt to grow your business, whether it is by acquisition or expanding production. Slow and steady doesn’t excite anyone, it won’t get you on the cover of any magazines, but it does lend itself to antifragility and long-term survival.

The smart boys in finance always think they’ll ride the wave and exit at the peak, and that’s at least theoretically possible if you’re just trading or in the VC game. But it’s not a viable approach to running an actual business that operates in the real economy.

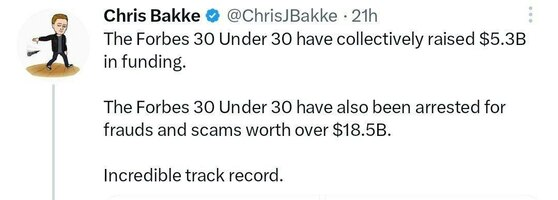

UPDATE: Let’s not forget that everything in Clown World’s corpocracy is fake and gay.